INSURANCE TRACKING

Verisurance's cutting-edge insurance tracking solution aids in mitigating insurance losses by ensuring borrowers maintain sufficient coverage, reducing the risk of losses due to uninsured or underinsured collateral.

INSURANCE TRACKING

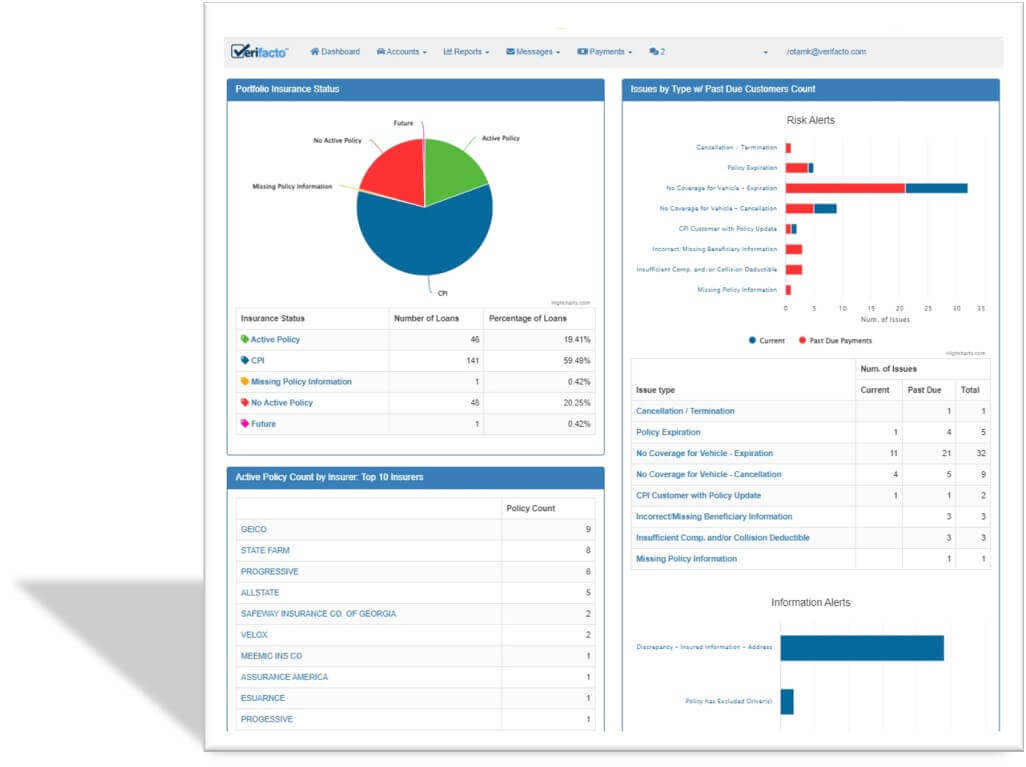

Verisurance stands out as a leading provider of cloud-based software, empowering auto dealers and lenders to effectively monitor their customers’ auto insurance status. Our platform offers a comprehensive and efficient solution, helping dealers and lenders manage and mitigate insurance risks. We accomplish this by delivering state-of-the-art technology through a customizable online dashboard, allowing users to access data, pull real-time reports with a single click, and efficiently communicate with drivers to swiftly address insurance concerns.

1 out of every 5 cars in the US is Uninsured. In many portfolios, the risk may rise to 1 out of 2 that are either Uninsured, Under-Insured or Improperly Insured.

Track insurance coverage on your loans: Verisurance ‘s insurance tracking solution allows you to monitor the insurance coverage on your existing and new loans, reducing the risk of issuing loans to borrowers who do not have sufficient insurance coverage. This ensures that your borrowers are complying with the insurance requirements in their loan agreements.

Time & Cost Savings: The platform saves time and money on staff expenditures by automating the customer communication process to resolve insurance issues, and by providing a quick and easy way to pull internal reports with a single click. This allows your team to focus on more valuable tasks

Document Management: The system provides document management for insurance notices, allowing dealers to store insurance notices for each customer’s account. In addition, the system stores customer communications for reference, reducing the risk of loss due to uninsured or improperly insured collateral.

Upgrade Your Risk Management Strategy with Verisurance 's Cloud-Based Insurance Tracking - Save Time, Money, and Gain Increased Control while Mitigating Losses!

Increased Control: Verisurance ‘s Insurance Tracking Software provides greater control and visibility into the portfolio, allowing for better decision-making and increasing overall profitability and portfolio value.

Reliable & Secure: The platform is built on the industry’s most reliable and secure technology, ensuring that sensitive information is kept safe and secure.

Great User Experience: The platform is simple and intuitive, providing users with a great user experience and allowing them to take care of business wherever and whenever they need.

Real Cloud Solution: Verisurance ‘s software platform is hosted on the most robust, reliable, and secure cloud servers in the U.S., ensuring that it is always available and easily accessible for users.

Detail insurance history for recovery and compliance: With Verisurance ‘s insurance tracking solution, you can easily access the insurance history of your loans, making it easier to recover losses and maintain compliance.

Automate customer communications to resolve insurance issues: Verisurance’s solution automates customer communications, making it easy to resolve insurance-related issues quickly and efficiently. In addition, Verisurance ‘s solution provides a central repository for storing customer communications related to insurance, making it easy to reference past conversations

Quickly pull internal reports with one-click: Verisurance ‘s system allows you to quickly pull internal reports with just one click, making it easy to access the information you need.